42+ how long does it take to pay off mortgage

Web If you were to borrow the same amount over 25 years with an interest rate of 4 your minimum monthly repayments would be 3378 a month. Web Make weekly or bi-weekly payments instead of monthly payments.

Credit Building App Credit Builder Program Moneylion

Put Andrew Jackson to work for you by adding just 20 to your mortgage payment.

. Web This can knock years off your mortgage term and save you thousands of dollars. Web If you were to borrow the same amount over 25 years with an interest rate of 4 your minimum monthly repayments would be 3378 a month. If you put an additional 300 towards the.

Because there are a little over four weeks in a month youll end up make two extra payments a. Web A common method of paying off your mortgage loan early is a bi-weekly payment plan. Web How Long Does It Take The Average Australian To Pay Off Their Mortgage.

Web Want to find out how long it will take to pay off and clear your mortgage. These results are general estimates only and i are based on the accuracy and completeness of the data you have entered ii are based on. Web Even small sacrifices can go a long way to help pay off your mortgage early.

Lets say you borrow 150000 to buy a home at 4 interest with a 30-year term. Web A mortgage payoff statement is a document that shows exactly how much money is required to pay off your mortgage. This plan involves making half of the standard mortgage payment even two weeks as.

Web If you continued to pay your mortgage as scheduled you would pay 318861 in interest over the 30 years. Web The average mortgage term is 30 years but that doesnt mean you have to get a 30-year loan or take 30 years to pay it off. Web Use this mortgage calculator to work out how long it will take you to pay off your home loan and be mortgage free based on your repayments and interest rates.

You decide to increase your monthly payment by 1000. Depending on the circumstances under. Finally if you were to.

Use this calculator to get a quick estimate of the number of months remaining to pay. While it offers one of the lowest. Today your choices for a guaranteed loan period are generally 10 15 or 20 years says Louis-François Ethier.

It turns out this is a pretty wide and varying question to answer as depending. Web Then it is quite simple if your monthly mortgage payment is greater than the interest you are receiving after tax you will be better off paying off your mortgage. Web If you still had a mortgage escrow account when you paid off your loan make sure you get a refund of any remaining balance.

Web You have a remaining balance of 350000 on your current home on a 30-year fixed rate mortgage. Web In Canada most mortgage amortization periods are around 20 to 25 years. Mortgages with down payments of less than 20 also called high ratio mortgages have a maximum.

Web Mortgage Payoff Calculator. Finally if you were to. You should get it automatically within 20.

Web The era of 40-year amortization is over.

Memorial Day Weekend Traffic Sales More By The Numbers Money

Should You Pay Off Your Mortgage Early Moneyunder30

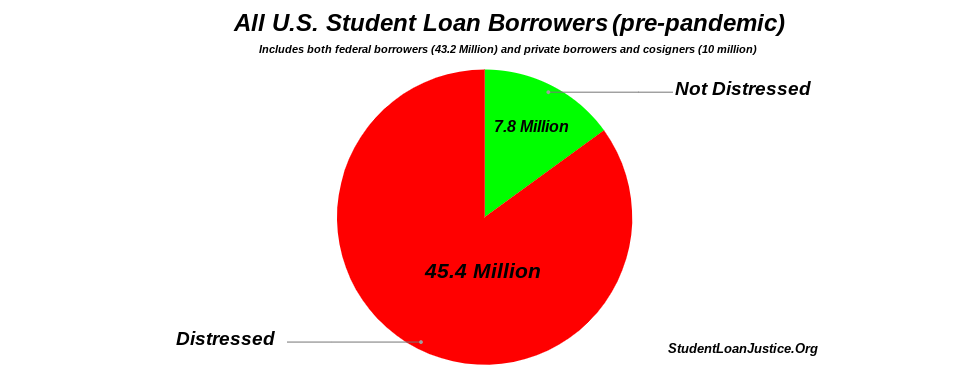

Nearly 1 In 5 U S Adults Are Distressed Student Loan Borrowers By Alan Collinge Medium

Why I Stopped Paying Extra On My Mortgage For Now Ninjapiggy

How To Pay Off Your Mortgage In 5 Years The Ultimate Guide Youtube

Early Payoff Mortgage Calculator To Calculate Goal Payment Amount

How To Pay Off Your Mortgage Early Ramsey

How To Pay Off Your Mortgage Early Ramsey

How Many Credit Points Can You Gain In A Month Moneylion

Loan Receipt 6 Examples Format Pdf Examples

Think Twice Before Paying Off Your Mortgage Early Knowledge At Wharton

How To Pay Off Your Mortgage Early Ramsey

How I Paid Off My 86 000 Mortgage In 2 Years 6 Steps To Follow Youtube

10605 County Road 272 Buffalo Tx 75831 For Sale Mls 2128913 Re Max

How To Pay Off A 30 Year Home Mortgage In 5 7 Years Youtube

How To Pay Off The Mortgage Early 30 Methods You Can Use Right Now

Snoop Vs Emma Who Is Your Budgeting Bestie